Earnings Week Ahead: Apple Reports Amid China Woes, Amazon Eyes Explosive Revenue

Next week, tech giants Apple and Amazon are expected to release their earnings reports.

We'll look at what to anticipate from their reports in this article.

We will also talk about a few more corporations that are scheduled to report in the same week as those two.

By following this link, you may use the MASTERPRO code to get a fantastic discount on your InvestingPro subscription.

Next week, when tech giants Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) take centre stage to give their quarterly reports, Q1 earnings season will get hotter. With the tech industry so far outperforming expectations, this will be the sixth of the seven Magnificent businesses to reveal their financial performance.

Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) sparked investor excitement this week, sending their prices surging 11% and 4%, respectively, in after-hours trade after exceeding analyst projections.

Conversely, Meta Platforms (NASDAQ:META) offered a different narrative. The company's stock fell almost 11% even though it beat estimates after providing flimsy second-quarter forecast and announcing plans to boost investment on AI research.

In spite of its Q1 financial performance being below expectations, Tesla's (NASDAQ:TSLA) shares surged, adding to the week's mix of unexpected events. The revelation of faster production and launch plans for lower-cost vehicles in the later half of 2025 sent the EV giant's stock price up by 12%, despite the fact that its numbers fell short of projections.

Now, all eyes are on Amazon and Apple for their earnings releases the following week, as investors anticipate further encouraging developments in the tech industry.

What Can We Expect From Amazon and Apple's Earnings?

Amazon

A potentially explosive earnings report from Amazon is coming up. Analysts predict triple-digit rise in profits per share (EPS) to 167.7% to $0.83 and double-digit revenue growth of 11.85% to $142.5 billion.

Investors should be encouraged by these tendencies over Amazon's impending report. Everything seems to be pointing to a solid performance that can raise the stock even higher.

Apple

As analysts revise downward their projections, expecting a decline in both revenue and profitability for the second quarter, Apple confronts a more gloomy picture than other tech companies.

Anticipated Outcomes:

The main cause of this change in opinion is a recent IDC report. The study showed a worrying 6.6% drop in smartphone shipments to China, one of Apple's most important markets. This revelation has added to the negative outlook, along with Apple ceding its top spot in the region to rival Huawei.

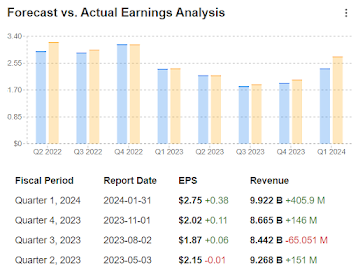

But it's crucial to take Apple's past success into account. The business has a proven track record of outperforming analyst earnings projections. In fact, according to statistics from InvestingPro, in three of the company's last four quarterly reports, Apple has exceeded expectations.

Anticipated Outcomes:

In previous reports, Apple has clearly shown its investors that it has rewarded them for exceeding revenue projections. Even with the market's present pessimism about Apple, investor sentiment might be greatly enhanced with a favourable earnings surprise. This is particularly crucial in light of the fact that Apple's stock price has dropped by 11.7% in 2024 thus far.

Bonus-Report on 2 More Tech Companies: Qualcomm and AMD

AMD

Though Advanced Micro Devices (NASDAQ:AMD) is positioned alongside NVIDIA (NASDAQ:NVDA) as a possible leader in the AI boom, analysts are lowering their expectations for the business. Estimates indicate that AMD's first-quarter revenue and earnings growth will be mild.

In particular, analysts predict $5.452 billion in revenue, which would represent a 1.85% growth. It is anticipated that earnings per share (EPS) will increase moderately, to $0.61, or 1.67%, over the current level.

But the past performance of AMD paints a contradictory picture. Despite the company's history of exceeding expert projections, the responses from the market tell a different tale. InvestingPro data indicates that in three of the last four quarters, the markets have responded negatively to AMD's earnings announcements. This negative sentiment is probably caused by AMD's propensity to provide disappointing long-term guidance in these releases.

AMD is facing two challenges at once: first, it must contend with industry heavyweights like Nvidia and Intel (NASDAQ:INTC); second, Chinese government regulations have limited the use of American-made microprocessors in government computers. Concerns are raised about AMD's future in the Chinese market by these regulations, which were released last month.

Surprisingly, AMD's stock price has increased by 4.2% despite this obstacle. Investors will need to wait until this earnings report to see if the growing Artificial Intelligence (AI) business can counteract the negative effects of the Chinese laws.

Qualcomm

Two important questions will be addressed by a detailed examination of the company's performance this quarter. First and foremost, investors want to know if Qualcomm is losing control of its core business. The forecast given for the upcoming quarter will be a crucial sign of any difficulties the chipmaker may be having with its main line of business.

Second, the study will clarify if Qualcomm is reaping the benefits of its strategic AI initiatives. The company's stock price has increased by about 13% so far this year, and AI might spur even more growth.

ProPicks can help you step up your investment game in 2024.

When it comes to AI-powered investing, institutions and billionaire investors around the world are already well ahead of the curve, heavily utilising, modifying, and improving it to maximise returns and reduce losses.

Users of InvestingPro may now accomplish the same task from the comfort of their homes with ProPicks, our flagship AI-powered stock-picking tool.

Investors get access to the best selection of stocks available on the market every month with our six strategies, which include our flagship "Tech Titans" strategy, which beat the market by an impressive 1,745% over the last ten years.

You should thoroughly understand the expenses and hazards of trading the financial markets before choosing to trade in cryptocurrencies or financial instruments. You should also carefully examine your investment. goals, degree of expertise, and risk tolerance, and when necessary, seek expert counsel.

Comments

Post a Comment